finPOWER Connect Comprehensive Credit Reporting Add-On

Comprehensive Credit Reporting allows for more information to be collected and reported on for each individual, including positive reporting information such as the repayments that have been made. It is used extensively internationally, and is far more predictive of default probability because you know more about the individual's behaviour than under a reporting structure where only adverse (negative) data is used.

Other benefits of CCR include:

- CCR can be used not only to highlight risk, but to identify opportunity. For example, under a negative reporting environment you may decline an individual based on a default from 3 years ago. However, CCR data may show you that individual has paid all accounts on time for the last 2 years – knowing this, would you have made a different lending decision?

- The power of CCR is very strong in the ongoing monitoring of accounts (portfolio management). Are your customers showing signs of payment distress elsewhere or taking on additional credit obligations? If you could see how they are performing in the market external to your portfolio, would you treat them differently?

- CCR can also be used to optimise your collections strategy. You will be able to see the individual's propensity to pay based on their score allowing you to efficiently allocate collection resources.

In finPOWER Connect the Comprehensive Credit Reporting Module assists with the initial load of data to a Credit Bureau as well as the ongoing Periodic load of monthly data. It simplifies the process to a monthly routine that will minimise your time commitment to CCR reporting.

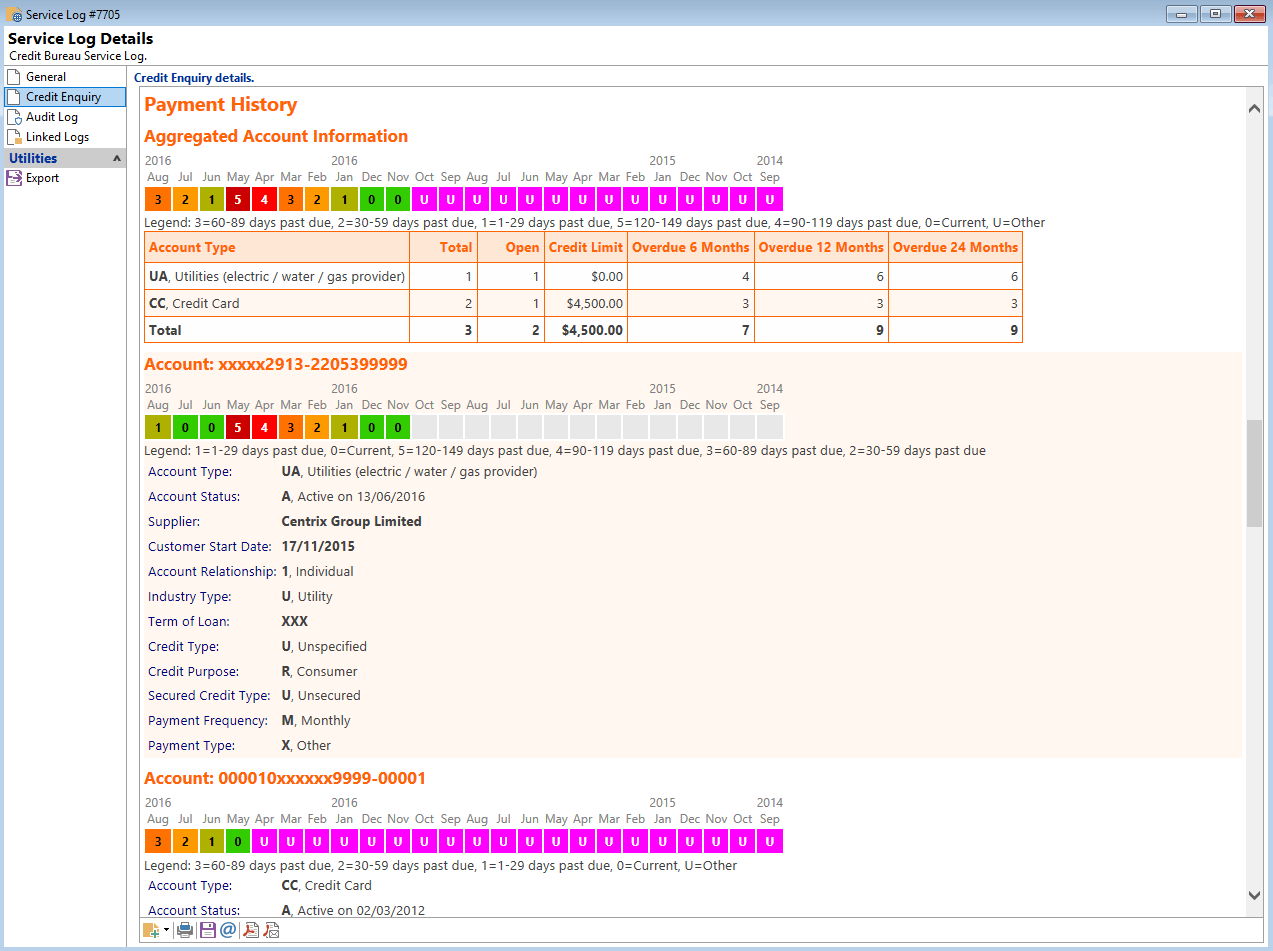

Once you have commenced CCR reporting with your Bureau, the Individual Credit Reports requested by finPOWER Connect through the

Credit Enquiry Add-On will include all the CCR data the Bureau has on the individual so you can better assess the application and view of the client.